Moving Forward with Greater Transparency

A significant milestone occurred in August 2021 when TNB announced our aspiration of achieving Net Zero Emissions by 2050. Building on this commitment, we then unveiled the TNB Energy Transition (ET) Plan.

TNB ET Plan which cuts across the electricity value chain focuses on three pillars, backed by initiatives to shift from fossil fuels to greener sources, aligning with its broader Reimagining TNB 2.0 (RT 2.0) programme. The three (3) pillars are accelerating generation decarbonisation, developing flexible and cross border grid, and empowering cross-sector electrification and prosumers. TNB’s ET plan continues to balance the Energy Trilemma and support the Malaysia’s target of 70% of renewable energy by 2050.

At TNB, we are committed to integrating sustainability into our business strategy and operations. By entrenching this culture of sustainability as a core value that drives our journey towards net zero, we can engage all our business entities, including our subsidiaries, to be active participants in this journey.

The Board Sustainability and Risk Committee (BSRC) remains dedicated to overseeing the effective implementation of sustainability initiatives with robust risk management to address exposures and harness opportunities and to ensure strategic integration of sustainability into operations and decision-making.

To embed sustainability into every facet of our operations, we are expediting the deployment and execution of ESG initiatives through collaborative efforts with our key stakeholders. A strong sustainability governance and leadership structure is vital to spearhead our sustainability agenda and provide us with clear and definitive guidance to achieve our net zero aspirations.To accelerate the TNB ET Plan and net zero aspiration, the TNB Sustainability Policy is established to drive a ethical, responsible, and sustainable practices. This policy sets a course for environmental, social, and governance excellence, aligning with legal requirements and international standards. Our aim is to drive positive change in the communities we serve, ensuring that our actions are sustainable and have a positive impact through fourteen (14) key focus areas in the Environmental, Social and Governance pillars in the TNB Sustainability Framework.

The TNB Sustainability Division stands as a cornerstone for strengthening sustainability governance and propelling our net zero aspirations. We prioritise actionable strategies to fulfil our sustainability commitments without impeding business growth. Integral to this journey is the digitalisation of ESG data and indicators, a key stride for transparent disclosure and well-informed decision-making. Together, we strive to achieve the highest sustainable impact and business growth through advancement in technology, process, and business model.

Leo Pui Yong

Chief Sustainability Officer

The Landscape

Global trends in the power sector are driven by four key areas: Net Zero commitment, electricity demand, energy transition, and regulatory reforms.

Sustainability stands as an unequivocal priority, with countries like Malaysia setting ambitious targets. At the core of sustainability lies electrification, and as its prevalence grows, electricity demand is projected to double by 2050, outpacing the demand for other fuels. In shaping the global energy transition, where decarbonisation, decentralization, and digitalization play pivotal roles, decarbonization emerges as the most impactful trend steering the development of new technologies:

Renewables are expected to grow significantly, with Malaysia targeting 70% of its 2050 installed capacity. Advancements in storage technologies are making renewables more dispatchable.

The sources of supply are diversifying, incorporating emerging green technologies like green hydrogen, carbon capture and storage (CCS) and nuclear small modular reactor (SMR).

As decentralization in power generation grows, the role of the grid becomes increasingly vital, shifting objectives towards enhanced flexibility and resiliency while upholding reliability and security. Digitalization is paramount to enable the grid of the future. Digitalisation takes centre stage in paving the way for the grid of the future, providing dynamic energy solutions for electricity customers

TNB Corporate Strategy

TNB's sustainability journey is anchored in the Reimagining TNB Strategic Framework. First introduced in 2016, it was enhanced in 2024 to guide TNB in growing a sustainable business by leveraging the energy transition for the Group's strategy and its aspiration 'to be a leading provider of sustainable energy solutions in Malaysia and internationally.

TNB SUSTAINABILITY PATHWAY: SETTING THE TARGET

Positioning for the future and moving forward towards energy transition, in August 2021 TNB announced our Net Zero Emission aspiration by 2050.

INTEGRATING SUSTAINABLE PRACTICES

As a responsible organization, TNB places its sustainability pillars – environmental, social and governance (ESG)

– at the heart of our progress

Environmental

Minimising our environmental impact wherever we operate.

Social

Developing long-term and meaningful relationships with our customers, employees, and communities.

Governance

Reinforcing ethical business practices and a forward-looking culture.

In today’s landscape where ESG considerations hold growing prominence in global business conversations, integrating ESG principles into our operations stands not just as an ethical necessity but also as a strategic endeavor bolstering TNB's long-term prosperity and resilience.

To infuse sustainability across all dimensions of our operations, we are accelerating the deployment and execution of ESG initiatives, fostering collaboration with our key stakeholders.

PRIORITIZING AND DIGITALIZING ESG INDICATORS

ESG elements encompass a wide range of concerns, spanning climate change, social responsibility, diversity and inclusion, and ethical governance.

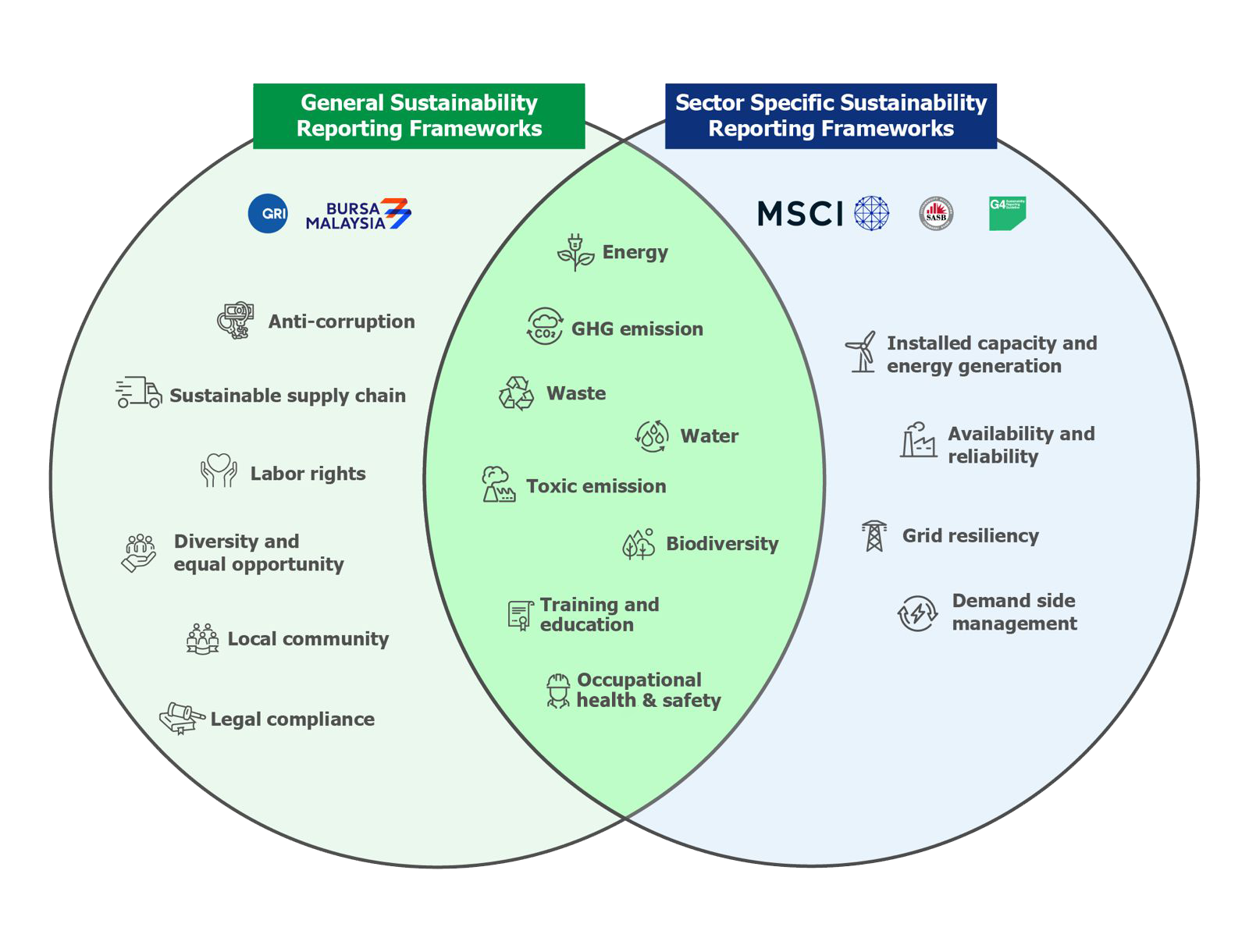

To bolster disclosure requirements and transparency, while effectively execute and orchestrate ESG initiatives across the TNB Group, TNB is consolidating over 150 ESG data indicators from various sustainability reporting frameworks. Integral to this journey is the digitalisation of ESG data and indicators, a key stride for transparent disclosure and well-informed decision-making.

Prominent sustainability reporting frameworks, including the Bursa Sustainability Reporting Guideline 3rd Edition and the Global Reporting Initiative (GRI) Standards, provide organisations with a standardised and consistent structure to disclose their ESG performance.

Diagram: TNB’s ESG data universe identified in accordance with existing sustainability reporting frameworks for greater transparency of its ESG performance management and disclosure.

The adoption of these frameworks promotes corporate accountability and transparency, allowing stakeholders to compare and analyse information across companies. Investors increasingly rely on established frameworks like MSCI ESG Ratings, SASB and sector specific GRI Standards to make informed decisions aligned with their values and risk tolerance.

Currently, TNB's sustainability reporting consistently aligns with both local and global sustainability standards and frameworks. TNB, aligning with these sustainability reporting frameworks, ensures stakeholders gain a comprehensive understanding of its ESG performance, facilitating global comparability.

SUSTAINABILITY REPORT 2024

We are committed to driving responsible growth, tackling key challenges, and creating lasting value for our stakeholders and the environment.

Our latest Sustainability Report shares the progress and the actions we are taking to create long-term value for all stakeholders.

TRANSITION FINANCE FRAMEWORK

Tenaga Nasional Berhad marks a significant milestone in its energy transition journey by establishing its inaugural Transition Finance Framework in September 2024, making it the first electricity utility player in ASEAN to do so.

The Framework is a set of guidelines to reinforce the link between TNB's financing and energy transition strategy by outlining criteria for existing or new projects that contribute to the transition in adherence with relevant market best practices.

Morningstar Sustainalytics, a globally recognised leader in ESG risk, ratings and data for investors, is of the opinion that TNB’s Transition Finance Framework is credible and impactful and aligns with Sustainability Bond Guidelines 2021 along with the four core components of the Green Bond Principles 2021, Social Bond Principles 2023, Green Loan Principles 2023 and Social Loan Principles 2023. Sustainalytics also opined that the Framework aligns with the ASEAN Sustainability Bond Standards 2018, the ASEAN Green Bond Standards 2018 and the ASEAN Social Bond Standards 2018.

For more information, please click on the documents below: