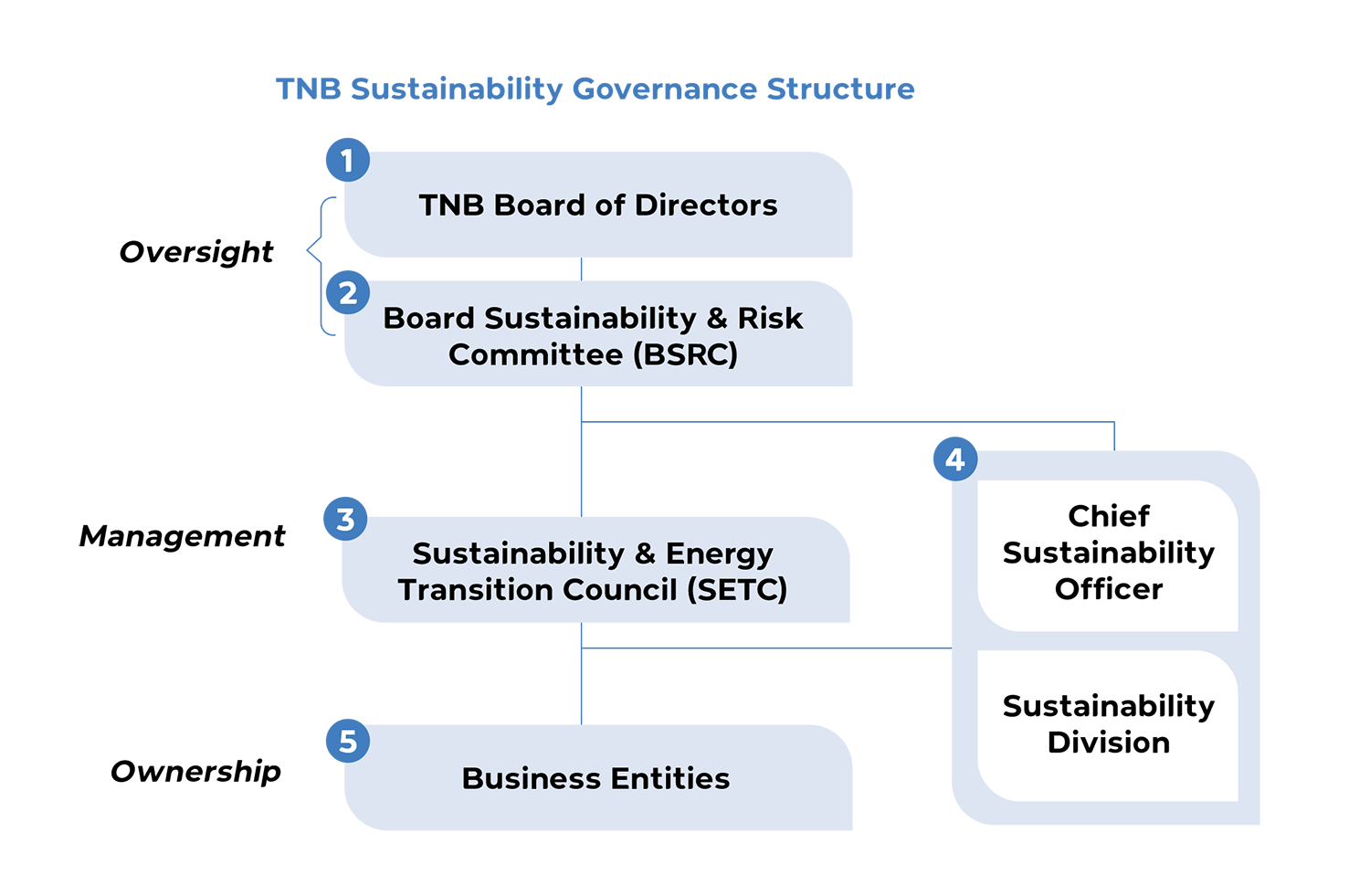

A strong sustainability governance and leadership structure are vital to spearhead our sustainability agenda and provide us with clear and definitive guidance to achieve our net zero aspirations. Our sustainability governance is an expansion of TNB’s Governance Model that is aligned with the principles of the MCCG. We believe that a robust sustainability governance framework underpinned by a supportive leadership structure are key components to ensure our sustainability agenda can be materialised through informative and comprehensive decision-making. Our sustainability governance is an essential part of TNB Group Governance Platform which is the framework of TNB management committees and sub-committees.

Our sustainability governance framework was reformed in Financial Year (FY) 2022 through formation of the Sustainability and Energy Transition Committee (SETC), with the objective of deliberating on energy transition initiatives to coordinate and oversee TNB's Energy Transition Plan and providing a platform for discussion on the sustainability agenda, development and implementation. This includes the energy transition direction and climate-related matters. The SETC has a combined roles to previous Sustainability Development Council (SDC) and TNB Energy Transition Steering Committee (TEXC).

Click here to read more about our strengthened sustainability governance structure.

ETHICS & GOVERNANCE

TNB is committed to conducting our business responsibly and with integrity to strengthen our stakeholders’ confidence. The Board is cognisant of its crucial role in demonstrating strong corporate governance and they are guided by our five Shared Values in accordance with the Code of Ethics for Company Directors as established by the Companies Commission of Malaysia.

These values are:

INTEGRITY

CUSTOMER FOCUS

BUSINESS EXCELLENCE

CARING

SAFETY

LINKS

TNB Corporate Integrity Health Index (IHI)

The Integrity Health Index (IHI) Dashboard was developed in 2021, serves as a systematic tool for information gathering to assess and ascertain TNB’s standings on integrity practices.

The enhanced version aims to broaden the scope of the IHI to include other elements apart from the survey to ensure it is holistic and taking into consideration the ESG, Business Ethics perspective.

In FY2024, we conducted an internal survey to evaluate TNB’s integrity practices, which received a high level of participation from 28,451 staff.

The results of the survey were impressive, with TNB achieving a score of 91.89% indicating that the organization is committed to maintaining the highest ethical standards in its operations.

RISK MANAGEMENT FRAMEWORK

Risk management in TNB is governed by the TNB Risk Management Framework, which adopts the principles and guidelines set out in ISO 31000:2018, ‘Risk Management – Guidelines’. Our TNB Risk Management Framework has been developed in line with the ISO 31000:2018 Risk Management – Guidelines.

It provides a structured and consistent approach to risk management across the organisation for informed decision-making.This framework, approved by TNB Board, provides a structured and consistent approach for risk management implementation across the Group. The purpose of risk management is to create and protect value and this is exemplified through each element in the TNB Risk Management Framework.