What is Goods and Services Tax (GST)?

Goods and Services Tax (GST) is a multi-stage tax imposed on taxable supplies of goods and services made in Malaysia, except those which are specifically zero-rated or exempted. In addition, GST is imposed on goods and services imported into Malaysia.

Is GST a new tax?

No. GST replaces the current Sales and Services Tax, effective 1 April 2015.

What are the supplies of electricity that are subject to GST?

For supplies of electricity to:

- Domestic customers in Malaysia: The first 300 kWh of electricity supply for a minimum period of 28 days per billing cycle will be subject to GST at the rate of 0%. The subsequent supply (above 300 kWh) will be subject to GST at 6%.

- Non-domestic customers in Malaysia: GST will be charged on the supply of electricity at the rate of 6%.

- Designated Areas (DA) for Langkawi & Tioman customers: GST is charged at the rate of 0% for Langkawi while there is no GST imposed for Tioman.

* Please note that there is no tax chargeable if electricity is supplied from DA to DA.

What are the examples of TNB’s services that are subject to GST, 6%?

List of services

- New connection or upgrade of connection.

- Testing of meter

- Providing street lighting

- Providing neon lighting or floodlight such as billboards, signage and buildings.

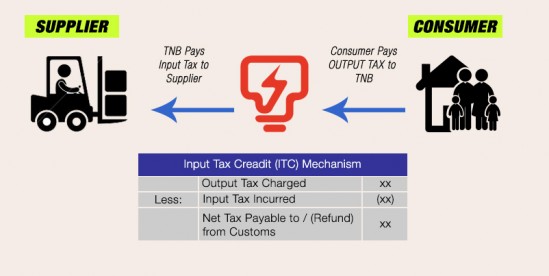

How does GST work?

Is my deposit for electricity supply subject to GST?

Deposit does not form part payment of the supply, hence it is not subject to GST.

Are late payment penalty on overdue accounts, power factor surcharge and connected load charge subject to GST?

The charges above are punitive in nature and not considered as part of the payment of the supply. Hence, the charges are not subject to GST.

If I only made a partial payment for my electricity bill, is it deemed to be GST inclusive?

Yes, it is deemed to be GST inclusive.

Will my electricity bill clearly state which items are subjected to GST?

Yes, the amount of GST charged will be clearly stated in the electricity bill issued to customer for the items which are subject to GST.

I am a GST registered person and would like to claim back the GST incurred on my electricity bill. Will TNB be providing me with a valid tax invoice for claiming purposes?

Yes, your electricity bill is a valid tax invoice and you are eligible to claim back the GST paid on your electricity bill if you are a GST registered person with Customs.